Beryl is a 76 year old woman receiving a single pension of $25,678 per annum, has a credit card debt of $15,000 and lives alone in her own home valued at $850,000. Beryl as a full pensioner is entitled to earn additional tax-free income up to $4800 per annum subject the Centrelink Income Test. This could potentially increase her annual tax fee pension income by up to 18% and make a difference to her life. This extra income plus a lump sum of $15,000 to retire her debt will help Beryl with the increasing costs of living.

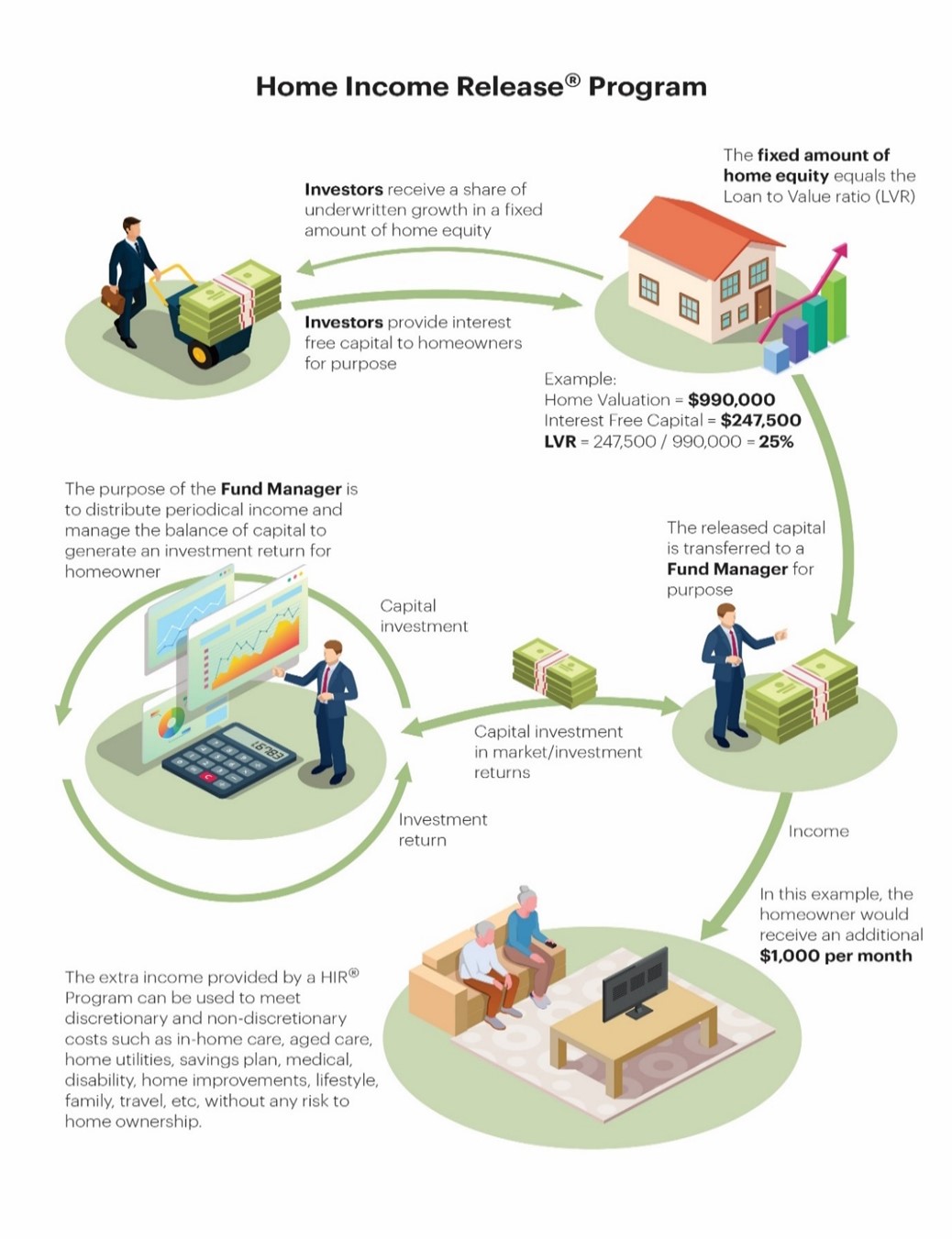

To generate this extra tax-free income and lump sum, Beryl agrees to assign growth in 14.7% of her home equity to the Lender. She will continue to benefit from any future growth in the balance of her home equity (85.3%). This enables her to release $125,000 of interest-free capital (14.7% of $850,000) from her home enabling the Lender to distribute Beryl an additional income amount of $4800 per annum, eliminate her $15,000 debt and generate for her an investment return over the term of the program from the balance of capital which will be used as an offset against the income Beryl receives during the HIR® Program term.

The extra tax-free income Beryl receives is priced at 4.5% of the capital release amount (4.5% of $105,750 = $4800 per annum after deducting the $15,000 credit card debt and Establishment Fee. The Lender deposits an additional tax free $400 every month into Beryl’s bank account and the Fund Manager generates a 3.5% pa investment return on Beryl’s undistributed capital ensuring most of her capital release amount is preserved over the HIR® Program term.

HIR® Program metrics

Home Valuation: $850,000

Capital Release Amount (CRA): $125,000 (released interest free capital)

Establishment fee (non-cash): $4300

Lump sum: $15,000

Loan to Valuation Ratio (LVR): 14.7% (agreed fixed equity value)

Income @ 4.5%: $4800 (per annum for as long as required)

Home Valuation (after 10 yrs): $1,200,000 (ave growth @ 3.5% pa)

RCV (after 10 yrs): $95,000 (offset against income distributed)

For Beryl, the compelling part of the HIR® Program is that it eliminated the worry Beryl had about her debt and income and was achieved without a negatively impacting her home ownership, domestic cash flow, savings, pension, superannuation, equity or home bequest value.